NOVI, Mich. — As automakers transition to building more connected and software-defined vehicles that can regularly receive over-the-air updates, OEMs must now contend with integrating vehicle hardware from different suppliers to ensure seamless connectivity.

A software-defined vehicle using a top-layer operating system still relies heavily on “middleware,” which acts as the “glue” that connects a vehicle’s various hardware components, experts said during a panel discussion moderated by Maite Bezerra, principal analyst for software-defined vehicles at Wards Intelligence, at this month’s AutoTech 2025 conference in Michigan.

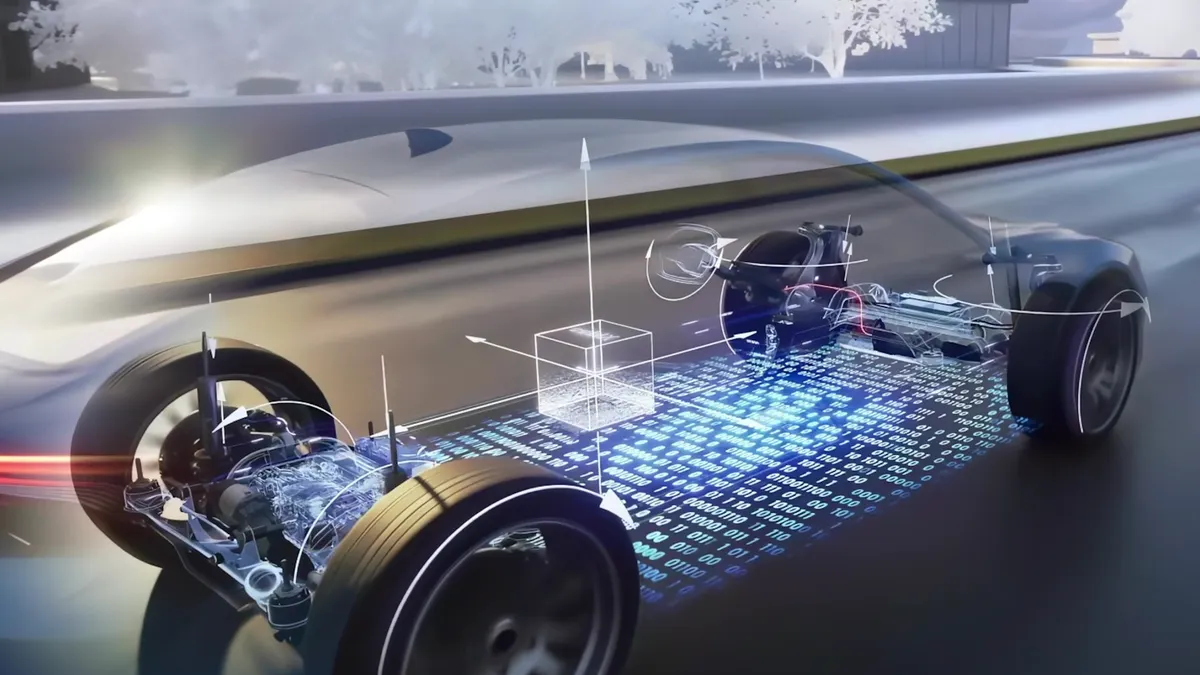

According to a December 2024 report from Wards Intelligence, the term “software-defined vehicle” refers to a broader digital transformation that’s occurring in the global auto industry. It includes advancements in vehicle platforms, such as such consolidated electrical/electronic (E/E) architectures, and the decoupling of vehicle hardware and software. But this transformation also extends to an automakers’ organizational processes, structures and Tier 1 supplier relationships, all of which play key roles in the vehicle development process, according to the Wards Intelligence report.

But with a large network of global suppliers providing hardware components to dozens of OEMs, the shift to building SDVs will also require a higher level of standardization, according to the panel participants, as well as a deeper collaboration with software developers that have traditionally served clients outside of the auto industry.

“As more OEMs adopt the software defined vehicle approach, the middleware shifts, as you said, from the background in terms of being kind of this glue that would connect software components and enable communication for different systems within a vehicle to now it shifts into this more critical role,” said panelist Brandy Goolsby, director business development and sales, embedded software at Vector North America.

Middleware can help automakers to manage increasing complexity

Middleware serves as an intermediary software layer that connects a vehicle’s different applications, systems and hardware components, allowing each to communicate and exchange data. It can help automakers better manage the growing complexity of SDVs, according to the panel participants.

Automakers have previously sourced hardware using embedded software developed by suppliers. But in order to create better digital experiences for customers, building SDVs requires an entirely different approach, and automakers must now consider the role of middleware in a modern vehicle. Customers today expect that their vehicles will always stay updated and evolve at the pace of personal consumer electronics, such as smartphones.

“This is a layer that will integrate and facilitate the interoperability of the different services and systems that will need to interact within this new modern vehicle architecture,” said Goolsby.

Vector is a developer of embedded electronics and software for networking microcontrollers and high-performance computers. The company also offers a vehicle OS and an open and modular software ecosystem for OEMs.

Additional challenges of SDV development

SDVs also will require a high level of interoperability between systems, which is a new challenge for legacy automakers that for decades adopted a hardware-centric approach to vehicle development. This interoperability ensures that automakers are able to deliver connected services that more customers expect.

But the development of SDVs also requires that automakers implement organizational changes within their corporate operations to support new product development, according to experts.

Another challenge for OEMs is ensuring that vehicle software meets a high level of cybersecurity, and automakers typically do not specialize in this critical area.

“You have to break the silos inside of the house, you have to break the silos outside of the house because we have to come together as an industry in order to really understand what can create together,” said Goolsby.

Disclosure: AutoTech2025 is run by Informa, which owns a controlling stake in Informa TechTarget, the publisher behind Automotive Dive. Informa has no influence over Automotive Dive’s coverage.