Lucid Motors is pushing forward with increased U.S.-based battery-electric-vehicle production, technology licensing efforts, and the retail rollout of its second model, the Gravity SUV, as it seeks to weather tariff uncertainty and a shifting demand environment.

On its first-quarter 2025 earnings call May 6, Lucid reported deliveries of 3,109 vehicles, a 58% increase from Q1 2024 and the company’s fifth straight quarterly delivery record. Revenue hit $235 million, up 36% year-over-year, bolstered by a surge in regulatory credit sales. Lucid's quarterly net loss of $366 million bettered Q1 2024’s $680 million loss, and it reaffirmed plans to more than double production volume this year.

Despite software-related delays that slowed some Gravity handoffs and Studio test-drive availability – Studio being the automaker’s answer to showrooms – CEO Marc Winterhoff emphasizes that the SUV’s rollout is gaining traction. “Three-quarters of orders are coming from customers new to the Lucid brand,” he says.

Lucid also sees strong early demand for the limited-run Gravity Dream Edition and notes its average selling prices (ASPs) are expected to rise as Gravity volumes are forecast to increase in the second half of 2025.

The Gravity joins the Lucid Air sedan in the upstart automaker’s lineup, which has been lauded by many for its extreme range and power. It was named a Wards 10 Best Engines & Propulsion Systems’ winner in 2022 and 2023.

However, as luxury sedan sales have cratered as customers, both in the mass-market and premium/luxury sectors, increasingly embrace utility vehicles, Lucid sales volume has been low. Lucid sold 10,421 vehicles worldwide in 2024, far behind the 1.8 million rival Tesla delivered. The Tesla Model Y SUV, not only the No.1-selling BEV in the world, but the top-selling model overall, accounted for roughly 1 million units of Tesla’s 2024 global sales.

U.S. assembly shields lucid from tariff fallout

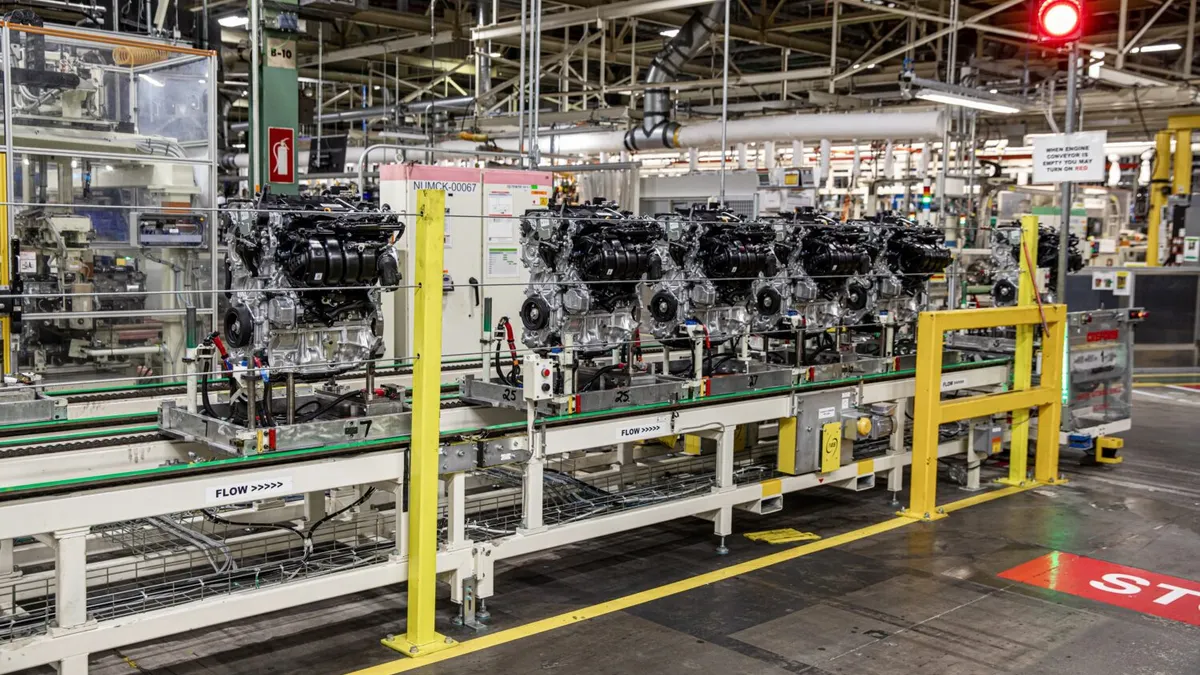

Lucid executives addressed growing concerns over the impact of auto tariffs and rare-earth material restrictions. While acknowledging a fluid global trade environment, Winterhoff cites Lucid’s vertical integration and U.S.-based manufacturing as a competitive advantage.

“We build all our vehicles and major components – including battery packs and drive units – right here in Arizona,” he says of the Casa Grande location. “This gives us flexibility many other OEMs don’t have.”

Lucid is also localizing the supply of key inputs. The company is transitioning to Panasonic’s new Kansas battery facility and sourcing domestic graphite through partnerships with Graphite One and Sera Resources.

Still, CFO Tofiq Kadhim notes Lucid expects gross margin headwinds of 8% to 15% due to tariffs, up from the 7% to 12% range projected in February. “This is a challenging situation,” he says, “but adversity is not new to Lucid.”

Tech licensing and factory expansion

Beyond vehicle sales, Lucid is actively exploring technology licensing and OEM partnerships, highlighting interest in its powertrain systems and software-defined-vehicle architecture. The automaker also confirms that it has held advanced discussions with several automotive manufacturers seeking to leverage Lucid’s Arizona manufacturing footprint for U.S.-based production.

“Some OEMs now see our technology as complementary to their own scaling needs,” Winterhoff says. “We’re not just building cars – we’re enabling the next wave of electrification.”

Lucid recently acquired key assets from Nikola’s Arizona operations for $17 million – a move it says adds strategic flexibility, expands capacity, and brings 250 new employees with EV expertise into the fold.

Looking ahead

Lucid reaffirmed its 2025 production target of 20,000 vehicles, up from 9,029 in 2024, with Gravity expected to account for most of the incremental volume. The automaker said Air volumes will likely remain stable year-over-year.

It also emphasized continued investment in its midsize platform, scheduled to launch in late 2026. That vehicle is expected to drive Lucid’s push toward profitability by increasing production scale and lowering fixed-cost absorption.

Lucid ended the quarter with $5.76 billion in liquidity, which executives said should carry operations through the second half of 2026. Capital expenditures for the year are projected at $1.4 billion, covering expansion at both its AMP-1 vehicle assembly facility in Arizona and AMP-2 assembly plant in Saudi Arabia.

“Our approach is to scale responsibly while staying capital-disciplined,” Kadhim says.

Dealer takeaway

For U.S. dealers watching the luxury EV space, Lucid’s strategy offers some notable signals:

- U.S. production is emerging as a retail advantage in a tariff-laden landscape

- The Gravity SUV is showing strong early demand and brand-expansion potential

- Lucid’s push into tech licensing and OEM partnerships could alter how EV platforms are sourced and supplied domestically